Ever wondered how to break free from the confines of conventional and concentrated liquidity AMMs? I’ve gathered all the ‘need to know’ about a true game-changer in onchain trading; a platform engineered to empower traders and liquidity providers like you and me with capabilities that turn the tide in our favor, offering a level of personalization and control previously unimaginable in the DeFi space.

Key Components of Carbon DeFi by Bancor

Order Types and Capabilities

Adjustability Features

Built in Execution Bot

Backtesting Simulator

Advanced Activity Tracker

The Technology at the Core

Order Types and Capabilities

Prior to diving into Carbon DeFi’s individual features, it’s crucial to highlight a truly game-changing advantage:

Strategy makers engage with the platform without incurring gas or trading fees upon order execution.

This is a monumental shift from the norm. You only pay for gas when creating or modifying a strategy, meaning your strategy can execute multiple trades without any additional cost burden.

Key Insights:

• Zero Cost on Execution

Unlike traditional platforms, executing trades on Carbon DeFi doesn’t bleed your wallet dry with fees.

• Inherent Smart Contract Design

The architecture of Carbon DeFi’s order types is ingeniously crafted.

By embedding functionality directly into smart contracts, the platform sidesteps reliance on potentially vulnerable external parties like oracles, hooks, and keepers.

This strategic choice not only streamlines operations but significantly boosts security by mitigating common DeFi risks, such as oracle manipulation.

• Robust Security

Carbon DeFi underwent three comprehensive audits before its public launch, ensuring a fortress-like security posture.

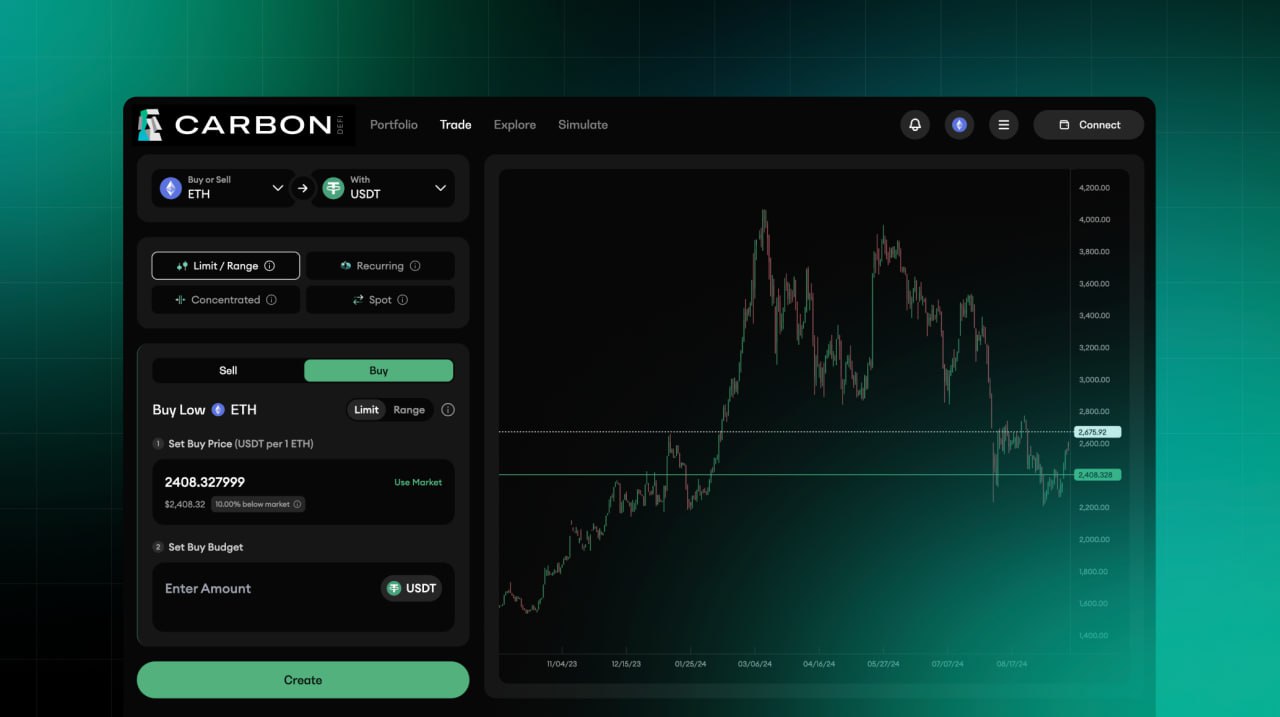

Peer-to-Peer Limit Orders

Carbon DeFi reintroduces the strategic essence of traditional trading with its native Limit Orders.

This order type allows you to set precise buy or sell targets, akin to the sophisticated systems seen in centralized exchanges — yet it remains firmly rooted in the ethos of decentralization.

Key Features:

• Exact Price Execution

Determine your ideal entry and exit points with unparalleled accuracy. Whether buying or selling, you control the price, ensuring your strategy unfolds exactly as planned.

• Zero Fees on Filled Orders

A standout benefit. When your limit orders are executed, you’re not burdened by trading or gas fees. It’s a cost-efficient approach that maximizes your investment potential, setting Carbon DeFi apart from the crowd.

• Intuitive Design

For those familiar with limit orders on centralized exchanges, the transition to Carbon DeFi is seamless. The interface is designed to feel intuitive, marrying traditional functionality with the innovative edge of DeFi.

Range Orders: Scaling In/Out Onchain

Innovating Beyond Traditional Limits

Carbon DeFi stands out with its Range Orders feature, a true differentiator in the landscape of digital trading. This functionality empowers traders to easily define a price range to trade within, with Carbon DeFi mapping out an extensive series of limit orders across the specified price range.

How It Works:

• Granular Control

Imagine setting a single order to sell Ethereum (ETH) as the price increases from $6,500 to $7,000. With Range Orders, this is now an onchain reality.

Behind the scenes, Carbon DeFi translates a range order into an intricate set of discrete limit orders, akin to placing a myriad of pinpointed bets across a spectrum of values in a conventional order book.

• Market Fluctuation Mastery

This structural detail makes Range Orders an ideal tool for navigating the often unpredictable waves of market volatility. It allows for a nuanced, dynamic approach to trading that can adapt to sudden changes, offering a level of precision and adaptability that traditional order types simply cannot match.

Why It’s a Game-Changer:

Range Orders redefine what’s possible in onchain trading. They provide a sophisticated mechanism for executing a strategy that’s both broad in its vision and precise in its execution.

This feature caters to the needs of traders looking to optimize their entry and exit points, leveraging market fluctuations to their advantage in ways previously deemed unattainable.

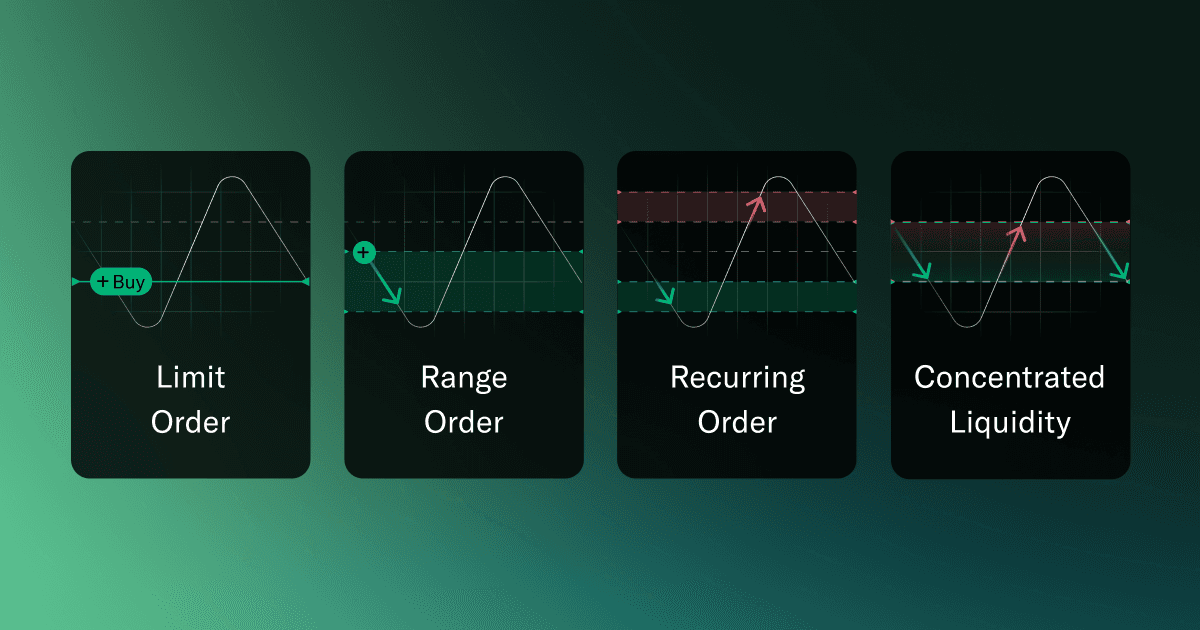

Recurring Orders: Automated Fading Strategies

Automation Meets Precision

Carbon DeFi introduces Recurring Orders, a feature at the forefront of trading automation.

This strategy type was designed to harness market volatility by intelligently linking buy and sell orders. As one order is fulfilled, it automatically sets the stage for the next, creating a self-sustaining cycle that capitalizes on the principle of “buying low and selling high.”

How It Elevates Trading:

• Perpetual Trading Cycle

Once an order is completed, the acquired tokens automatically finance the subsequent opposite order, setting in motion a continuous loop of strategic transactions.

This cycle is akin to having a personal trading bot or grid system, meticulously executing buys and sells at predefined levels.

• Token Accumulation and Profit Compounding

Through this cyclic process, not only do you accumulate tokens by capitalizing on favorable market conditions, but you also compound your profits over time, streamlining what would otherwise be a demanding and complex manual trading strategy.

• Customizable Linked Orders

Carbon DeFi offers unparalleled flexibility, allowing you to link various order types such as limit-limit, range-limit, limit-range, or range-range. This customization ensures that your trading strategy aligns perfectly with your market expectations and investment goals.

• Initiate a Limit Order With Resources You Don’t Yet Possess:

You’re not required to fund both sides of the strategy upfront. This means you can effectively leverage future gains to fuel your current trading strategy, a unique competitive edge for strategy makers.

Recurring Orders by Carbon DeFi not only simplifies the trading process but democratizes access to advanced trading tactics previously reserved for only the most sophisticated trading systems.

Concentrated Liquidity: The Next-Generation

Mastering the Short-Straddle (or Short-Gamma) Position in DeFi Trading

A Leap in Trading Efficiency

At its core, Carbon DeFi's Concentrated Liquidity represents a special arrangement of linked range orders. It’s not just an addition to the platform’s robust order types; it’s a leap towards a new era of concentrated positions tailored for the individual user, offering:

• Customizable Spread AKA Fee Tiers

Break free from the constraints of conventional concentrated liquidity models.

With Carbon DeFi, you’re no longer tied to pre-defined fee tiers. Instead, you have the power to set your own spreads, opening the door to personalized trading strategies that match your unique risk and reward profile.

• Gas-Efficient Strategies

Carbon DeFi stands out by allowing traders to establish concentrated liquidity strategies within any price range in a gas-efficient manner. This ensures that your trading activities are not only strategic but also cost-effective, maximizing your potential returns.

This forward-thinking approach provides a significant advantage, empowering you to craft strategies that leverage concentrated AMM positions without the traditional limitations.

By enabling traders to choose their fee tiers and efficiently manage liquidity within any price range, Carbon DeFi is not just accommodating the needs of today’s traders — it’s anticipating the demands of tomorrow’s markets.

Flexibility at Your Fingertips

The ability to swiftly adapt to market changes is not just an advantage; it’s a necessity.

Carbon DeFi rises to this challenge, revolutionizing onchain trading with unmatched adaptability. Through a blend of advanced technologies, an intuitive interface, and a suite of versatile order types, Carbon DeFi empowers traders to fine-tune their strategies with unprecedented ease and efficiency.

• Modify Pricing

Seamlessly modify the buy and sell prices of your tokens on the fly.

With Carbon DeFi, there’s no need to cancel orders, withdraw, redeposit funds, or set up new strategies.

Modifying pricing allows for quick adjustments, allowing you to position yourself exactly where you want to be in the market.

• Modify Position Size: Add and Withdraw Funds

Enhance or reduce your stake in a strategy at any moment, without losing the essence of your strategic approach embedded in the smart contract. Whether it’s a partial withdrawal or a complete exit, your strategy remains intact, ready for reactivation whenever you choose.

• Pause and Unpause

Take control of your trading with the ability to pause and unpause trading activities.

Pausing ensures your tokens are temporarily off-limits for trading, allowing for strategic recalibrations.

Unpausing swiftly reengages your positions at your newly defined parameters.

This flexibility is invaluable in a market known for its rapid shifts and turns, offering traders a significant edge. Whether tweaking prices, adjusting positions, or taking a moment to reassess strategy without losing ground, Carbon DeFi positions its users for potential success amidst the volatility of the DeFi landscape.

Efficient Order Execution: A Built in Arbitrage Bot

The Ultimate DEX/Bot Hybrid

In the quest for unparalleled efficiency in DeFi, the innovative minds at Bancor unveiled a groundbreaking solution: the Arb Fast Lane. This open-sourced, permissionless arbitrage framework is seamlessly integrated into Carbon DeFi’s ecosystem, distinguishing itself with a unique proposition.

In a landscape craving efficiency and innovation, the DEX/Bot Hybrid design of Carbon DeFi and the Arb Fast Lane set a new benchmark, blending the traditional prowess of trading bots with the transparent, decentralized nature of DEXes.

• Bridging Markets with Precision

The Arb Fast Lane is not just an addition; it’s a conduit connecting Carbon DeFi’s markets with the vast liquidity pools across the blockchain. Its deployment signifies a monumental leap towards ensuring swift and timely order execution for traders, embodying a bridge that spans across the entire liquidity base of the deployed chain.

• Passive Mining Operations

Through the Arb Fast Lane, market participants find a unique pathway to DeFi engagement, reminiscent of passive mining operations.It offers a blend of active trading benefits with the passive income allure, enriching the DeFi experience.

• Hybrid Market Making Systems

The synergy between Carbon DeFi and the Arb Fast Lane Protocol illustrates a hybrid approach that marries the best of both worlds. What emerges is a system that mirrors the functionality and efficiency of a traditional trading bot, yet is deeply rooted in DeFi principles.

Carbon DeFi, bolstered by the Arb Fast Lane, emerges as a powerhouse in the DeFi space. It combines the ability to craft custom trading strategies with the introduction of novel order types, enhanced order execution, and an automated approach to market arbitrage.

Sharpening Your Edge: The Power of the Carbon DeFi Simulator

A Beacon for Strategic Clarity

The Carbon DeFi Simulator stands as a lighthouse, guiding traders through the turbulent waters of the market.

It’s not just a tool; it’s your strategic partner, offering impartial insights into trading opportunities that span across any standard ERC20 token pairs, including, and especially exotic token pairs.

Beyond Traditional Analysis

The Simulator breaks free from the conventional confines of USD, ETH, and BTC denominations, allowing for a broader spectrum of analysis with any token as the numeraire.

This feature is a game-changer, enabling users to delve into historical market data and price charts with unparalleled depth and flexibility.

Whether you’re assessing Carbon DeFi’s strategy options or exploring uncharted token pairs, the Simulator equips you with the means to develop a keen intuition for the platform’s capabilities.

From Testing to Triumph

• Intuitive Learning

The core mission of the Simulator is to transform users from observers to strategists.

By offering a hands-on approach to learning through historical data analysis, it bridges the gap between theoretical knowledge and practical execution.

• Seamless Strategy Integration

With its flawless incorporation into Carbon DeFi’s interface, transitioning from strategy testing to live execution is as smooth as it gets, ensuring a cohesive and efficient trading journey.

• Customization at Your Fingertips

Tailor your simulation with an array of options, from choosing “Recurring Orders” to experimenting with “Overlapping Liquidity.” Set your price targets and manage your budget with ease, crafting strategies that align perfectly with your trading style and objectives.

• Insightful Analytics for Informed Decisions

Upon concluding a simulation, you’re not just left with hypothetical outcomes. The Simulator offers a treasure trove of analytics:

Dynamic Charts

Performance Summaries

Comprehensive Trade History Log and more

By providing detailed analytics and flexible simulation options, it ensures traders are well-equipped to navigate the DeFi landscape and understand Carbon DeFi’s market mechanics, making it an indispensable asset for anyone looking to harness the full potential of Carbon DeFi’s innovative trading platform.

Dr. Mark Richardson demonstrates exotic trading pairs resulting in upwards of 250% ROI vs HODL

A New Era of Transparency and Efficiency

With the introduction of the Activity Tracker, Carbon DeFi has shattered previous barriers to data accessibility. Updated every 30 seconds, this dynamic tool provides an unparalleled depth of insight into:

• A Specific Strategy:

Zoom in on the nuances and performance metrics of individual strategies, understanding every move and its impact.

• All Your Strategies:

Get a holistic view of your trading endeavors, aggregating the data across all strategies you’ve deployed.

• System-Wide Strategies:

Broaden your perspective with a bird’s eye view of the ecosystem’s overall trading activities, capturing trends and movements across the board.

Beyond Traditional Boundaries

Before the advent of this feature, traders waded through the murky waters of smart contract analytics or leaned on external data queries for insights — a cumbersome process still plaguing users of other DEX platforms, especially within the AMM landscape.

The Activity Tracker by Carbon DeFi transcends these challenges, integrating strategy activity directly into the user interface, making data not just accessible but effortlessly so.

Why This Changes Everything

By consolidating critical trading data into an intuitive, real-time dashboard, Carbon DeFi empowers its users with the knowledge to make informed decisions swiftly. This tool democratizes data analysis, transforming it from a complex, time-consuming task into an integral, seamless part of the trading experience.

The Technological Evolution Reshaping DeFi

A Legacy of DeFi Breakthroughs

Carbon DeFi isn’t just another platform in the decentralized finance (DeFi) ecosystem; it’s the culmination of years of pioneering work by Bancor, a name synonymous with innovation in the DeFi space.

From the inception of bonding curves and AMMs to the development of pool tokens, Bancor has consistently led the charge in shaping the landscape of DeFi technology.

2017: The Dawn of AMMs

Bancor set the DeFi world alight by introducing the first Automated Market Maker (AMM) based on its Constant Product technology. This breakthrough allowed liquidity providers to ensure market liquidity across all price levels, a boon for emerging tokens looking to gain traction.

2020: Concentrated Liquidity

Advancing their vision, Bancor unveiled Concentrated Liquidity technology, then known as Amplified Liquidity. This iteration refined the canonical AMM model by mitigating price slippage and focusing liquidity within specific price ranges, enhancing trade efficiency and market stability.

2022: From AMMs to Asymmetric Liquidity

Continuing on its path of innovation, Bancor launched Carbon DeFi, armed with a Novel Invariant Function and Asymmetric Liquidity Pools — referred to as Asymmetric Liquidity and Adjustable Bonding Curves. This development introduced dual adjustable curves for buying and selling, reshaping the DeFi landscape once again.

2023: Revolutionizing Arbitrage

The introduction of the Arb Fast Lane Protocol in March 2023 marked a new frontier for DeFi arbitrage. This permissionless arbitrage bot, integrated within the Bancor ecosystem, incentivizes users to bridge price disparities across exchanges, with nearly 50% of the trade awarded to successful traders. This not only enhanced order execution within Carbon DeFi but also fortified its position as a leading DeFi platform.

Bancor’s relentless pursuit of innovation has not only shaped the foundation upon which Carbon DeFi stands but has also pushed the boundaries of what’s possible in DeFi.Each technological milestone — be it the evolution from Constant Product AMMs to Concentrated Liquidity to Asymmetric Liquidity and the groundbreaking Arb Fast Lane Trading Bot — illustrates Bancor’s unwavering commitment to advancing the DeFi ecosystem.

Your Singular Solution for Onchain Trading

Revolutionizing the DeFi Ecosystem with Unmatched Sophistication

Carbon DeFi emerges not just as a beacon of innovation but as the very embodiment of trading sophistication.

With its rich arsenal of advanced order types, pioneering hybrid DEX/Bot architecture, cutting-edge Backtesting Simulator, and Advanced Activity Tracker, Carbon DeFi redefines what traders can expect from the DeFi space.

Unleashing the Power of Advanced Trading

• Precision and Strategy with Limit Orders

Carbon DeFi takes precision to the next level, allowing traders to set exact entry and exit points with Limit Orders, ensuring trades are executed at the most opportune moments.

• Adaptability through Range and Recurring Orders

The platform’s Range and Recurring Orders offer unmatched strategic flexibility, enabling traders to adapt their strategies in real-time to the ever-changing market conditions.

• Commanding Control with Concentrated Liquidity

Overlapping Liquidity strategies offer a level of control previously unseen, allowing traders to finely tune their market positions to capture the best trading opportunities.

Beyond a Platform: A Gateway to Trading Excellence

Carbon DeFi transcends the traditional boundaries of a trading platform and stands as a gateway to unleashing trading potential, offering a suite of tools designed not just for navigating but for mastering the volatile crypto markets.

For the sophisticated trader looking to forge ahead in the rapidly evolving world of decentralized finance, Carbon DeFi offers the ultimate toolkit for success.

Looking Ahead

As 2024 unfolds, Bancor sets the pace for the DeFi world, driven by its strategic expansion across an array of blockchain networks, including:

Bancor Deployments of the Arb Fast Lane Protocol

Licensed Third Party Deployments of Carbon DeFi’s Smart Contracts

Mantle by Velocimeter

Base by Velocimeter

Fantom by Velocimeter

Charting the Future: A Horizon Broadening with Every Step

The road ahead for Bancor and its flagship innovations, Carbon DeFi and the Arb Fast Lane trading bot, is anything but static.

With a series of strategic deployments poised to unfold across a spectrum of blockchain ecosystems — including Arbitrum, Linea, Blast, Sei, Canto, Scroll, Metis, Movement, Shardeum, and BSC — Bancor is on the brink of ushering in a new era for decentralized finance.

A Testament to Innovation and Growth

This ambitious expansion plan is a clear testament to Bancor’s dedication to pushing the boundaries of what’s possible in DeFi. Each new launch not only broadens the reach of Bancor’s pioneering technologies but also integrates them into the fabric of the DeFi ecosystem, marking the start of a transformative journey for traders worldwide.

Boundless Potential on the Horizon

As we look to the future, the possibilities for reshaping the onchain trading landscape appear limitless.

Every integration, every deployment brings with it a wave of innovation, arming traders with increasingly sophisticated tools and unlocking access to untapped markets.

This is just the beginning of a journey marked by continuous advancement and groundbreaking developments. Stay tuned, for the best is indeed yet to come.

Carbon DeFi is a product of Bancor and governed by the Bancor DAO.

For more on Carbon DeFi

Website | X/Twitter | Telegram | YouTube

For more on Bancor and its latest innovations

Website | Blog | X/Twitter | Arb Fast Lane Bot | YouTube | Governance