Sei Network, known as the “Fastest Layer 1,” is experiencing rapid TVL growth and boasts a vibrant DeFi community. Among its many DeFi opportunities, concentrated liquidity is emerging as one of the most compelling.

In this blog, we’ll explore why you should create a concentrated liquidity position on Carbon DeFi on Sei, and how to do it in 3 easy steps.

TL;DR

• What is concentrated liquidity?

• Concentrated liquidity on Carbon DeFi

• How to create a concentrated position on Carbon DeFi on Sei

https://defillama.com/chain/Sei

What is Concentrated Liquidity?

Concentrated liquidity allows liquidity providers (LPs) to allocate capital within a specific price range rather than spread liquidity evenly across all prices, as seen in traditional AMMs.

By focusing liquidity where trading happens most, LPs have the opportunity to earn greater fees while providing less capital. This efficiency in capital allocation is what makes concentrated liquidity so appealing to DeFi traders, and platforms like Carbon DeFi by Bancor take it even further by offering highly customizable features and infinite capital efficiency.

Beyond AMMs– Carbon DeFi’s Concentrated Liquidity

• Auto-Compounding Fees

Unlike many platforms that require manually adding fees to an existing position, Carbon DeFi auto-compounds fees, maximizing returns for liquidity providers without any extra effort or cost.

• Infinite Capital Efficiency

Carbon DeFi boasts a capital efficiency that is unmatched in the market, proven to be 20,000,000x more capital efficient than a standard liquidity pool and 1,000x more efficient than concentrated liquidity AMMs, enabling liquidity providers to optimize their capital like never before.

• Built-In Solver System

Carbon DeFi’s built-in solver system dynamically taps into liquidity across the entire Sei network. This system ensures that traders on Carbon DeFi can seamlessly trade against liquidity from other DEXes on Sei, enhancing market depth and improving trading efficiency. By using liquidity from across the network, Carbon DeFi positions are optimized, providing better execution for both makers and takers.

• Rebalance on the Fly

Want to edit your position? Carbon DeFi eliminates the need to withdraw and redeposit funds, saving you time and gas.

• Customization

With Carbon DeFi, users have the power to tailor their liquidity strategy with phenomenal precision. You can set custom fee tiers, adjust your price range, and create liquidity positions completely free from the limitations of ticks, or predefined ranges.

• Tick-Free Flexibility

Carbon DeFi breaks away from the tick-based system used by most concentrated liquidity AMMs. This tick-free design means that liquidity providers can manage their positions with far greater flexibility and efficiency, deploying liquidity exactly where they want it.

How to Create a Concentrated Position

Creating a concentrated liquidity position on Carbon DeFi is simple and powerful. Here’s how to get started:

1. Choose Your Token Pair

Pair any standard ERC20 tokens on Sei, regardless of how unique the pair is. Unlike traditional concentrated liquidity AMMs, Carbon DeFi doesn’t rely on liquidity pools, giving you greater flexibility and control over your strategy.

2. Customize Your Price Range and Fee Tier

• Tailor your liquidity position by selecting a specific price range in which you want your liquidity to be active.

Additionally, Carbon DeFi offers customizable fee tiers, allowing you to set the optimal fee structure for your strategy.

*Remember, with Carbon DeFi your fees are auto compounding!

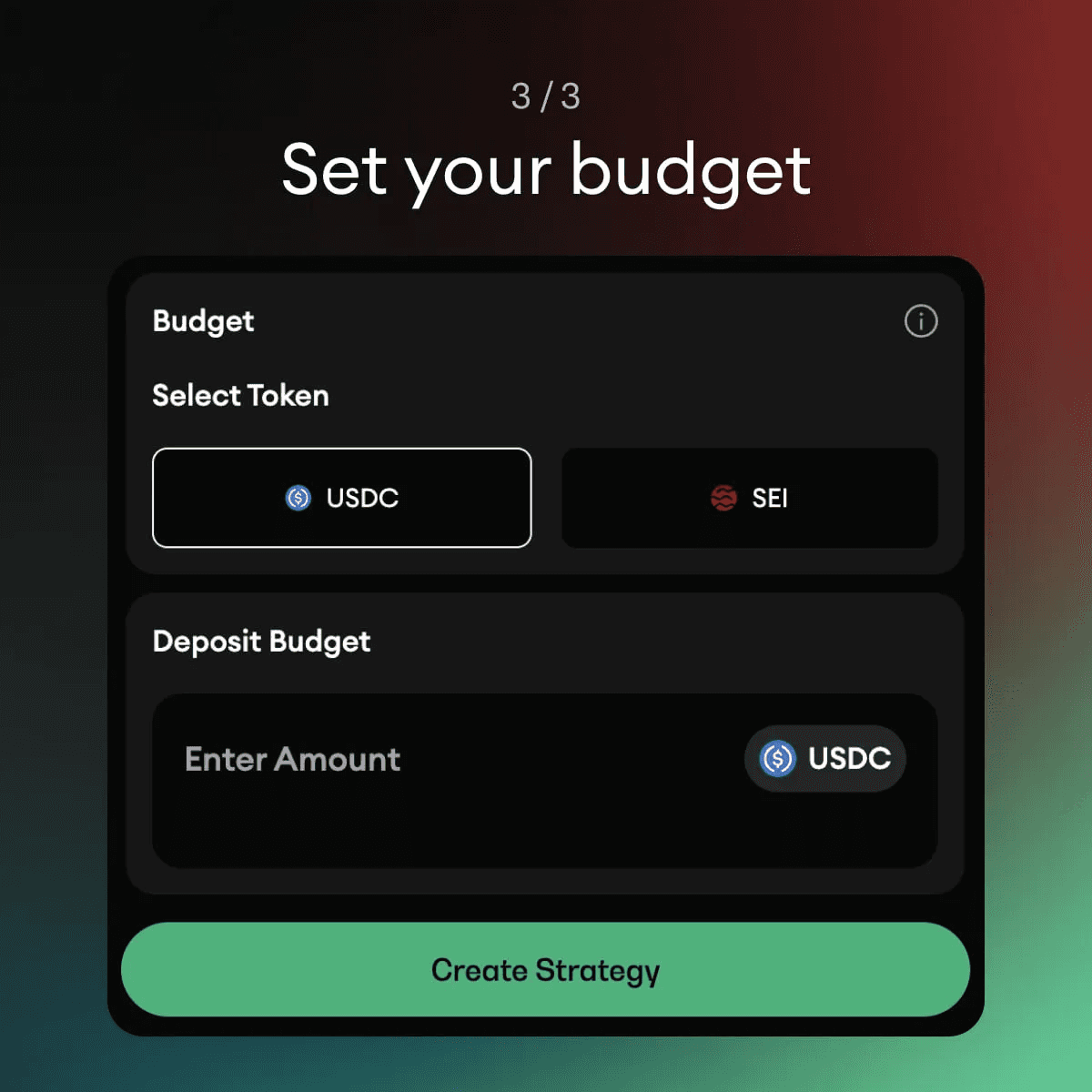

3. Set Your Budget

Determine the amount of capital you want to allocate to this position.

View Position Activity in Your Portfolio

"Prior to this feature release, collecting such data meant delving into the complexities of smart contracts or depending on dune queries for insights — a necessity still present in other DEXes, particularly AMMs.

Get real-time insights into strategy performance with detailed logs of actions such as buy/sell triggers, price ranges, and budget adjustments. This feature is integrated directly into the user interface, making it easy for traders to make informed decisions and optimize their positions. Tailor information to your exact needs with various filter options and a one-click CSV export feature.”

Summary

Carbon DeFi on Sei unlocks a new era of concentrated liquidity with unprecedented capital efficiency, customization, and real-time insights. Whether you’re looking to optimize your liquidity, capitalize on Sei’s fast-growing DeFi ecosystem, or experiment with trading, Carbon DeFi is the ideal platform to get started.

Step beyond the limitations of traditional AMMs and experience the future of DeFi with Carbon DeFi.

Visit sei.CarbonDeFi.xyz/trade today and experience firsthand the difference in capital efficiency, flexibility, and chain-wide liquidity.