At the heart of decentralized finance, Carbon DeFi stands out as a beacon for LPs and traders, offering a comprehensive and sophisticated suite of tools specifically designed to meet their needs. With the introduction of Concentrated Liquidity, Carbon DeFi adds concentrated positions, reinforcing it as the ultimate destination for those looking to master DeFi liquidity with ease and efficiency.

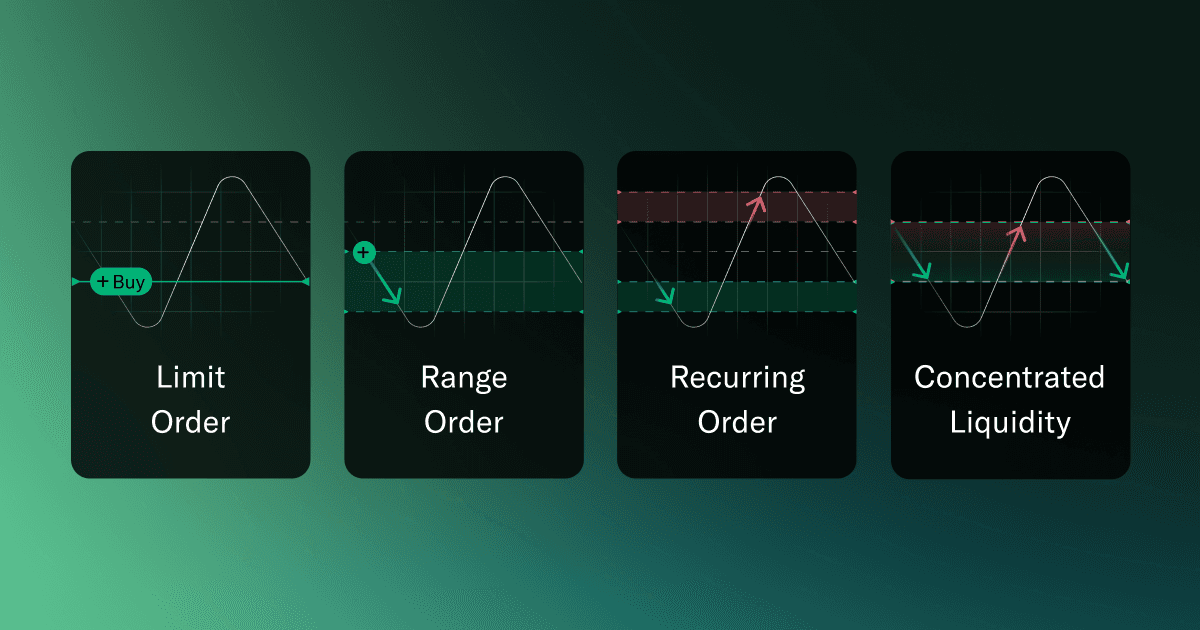

Understanding Carbon DeFi’s Rich Suite of Order Types

Carbon DeFi’s robust platform is engineered to support a variety of strategies, each tailored to meet the diverse needs of the DeFi community.

Limit Orders: This classic tool enables traders to set exact buy or sell prices. No trading fees or gas fees on filled orders.

Range Orders: A standout feature exclusive to Carbon DeFi — enables trades within specific price ranges, ideal for scaling in/out of a position.

Recurring Orders: Carbon DeFi’s exclusive feature streamlines trading by linking buy and sell orders with a single liquidity source, simplifying complex scenarios and maximizing on market volatility. It enables continuous buying low and selling high, allowing for token accumulation and profit compounding.

Concentrated Liquidity: Enables traders and DAOs to manage concentrated liquidity positions within specific price ranges easily and efficiently onchain. Drawing from Automated Market Maker (AMM) models, this tool allows for direct customization of your spread.

Tailored Management Features for the Modern Maker: Customizable Fee Tiers (Bid-Ask Spread) and More

In contrast to prototypical concentrated liquidity models, which have a preset bid-ask spread parameter (aka the “fee” level), Carbon DeFi’s concentrated liquidity allows its creators to choose their own spread, free from implementation specific constraints, such as tick boundaries.

Choose your price range: “I want to make the market for ETH/USDC between $1,500 and $3,000”.

Choose your spread: “My asking price is 10% higher than my bidding price; I’ll let ETH sellers take my USDC at $2,000 but ETH buyers can take my ETH at $2,200.”

Choose your market depth: “I will provide a total of $10,000 in ETH and USDC to this market.”

Carbon DeFi is not just about diverse trading strategies; it’s also about offering users unparalleled control and efficiency in managing their trades with no trading or gas fees on filled orders.

The Maker’s Choice: Carbon DeFi

With the introduction of Concentrated Liquidity and a relentless dedication to innovation, Carbon DeFi solidifies its status as the premier protocol for makers in the decentralized finance realm. This latest enhancement enriches Carbon DeFi’s already sophisticated suite of trading tools, blending traditional methods with groundbreaking order types and abilities, all backed by intuitive management features. It’s not just a trading platform; it’s a meticulously crafted hub designed for those who seek to master the nuances of DeFi trading. Join the ranks of savvy LPs and traders who choose Carbon DeFi for its unmatched capabilities, and experience a new standard in decentralized trading.